Brand new data.

Same old story?

It sure feels that way when we look at still another study that has surveyed advisors to understand what they want from their wholesaling partners.

And, drum-roll please, nothing has changed, with exception of the topics that advisors wish to be educated on.

This chart distills the findings of two key questions:

How interested are you in receiving content and/or support on each of the following topics?

What are your preferred ways of receiving content/support from asset managers?

source: Broadridge – used with permission. 300 advisors surveyed. 46% wires, 27% IBD, 15% RIA and 12% Regionals.

Our observations

- Wholesalers are not destined for extinction. As evidenced by the fact that 54% of advisors want the information that they seek delivered by wholesalers underscores the notion that, while there are other delivery mechanisms, nothing replaces the professional, knowledgeable distribution partner.

- Advisors demand deep knowledge. Many of the responses cited under Support Areas of Interest are not topics that can be addressed simply by quoting facts from a “sales idea”.

These topics require a depth of knowledge that, when displayed, clearly separates the wholesaler from The Sea of Sameness.

- Once again, the need for you to create and market your PVP-Peerless Value Proposition® is, via this newest piece of evidence, smacking you square up side the head.

Wholesalers who continue to deny its importance, do so at their own career peril.

Use this link to see everything we’ve ever written/recorded that speaks to PVP-Peerless Value Proposition®.

Better still, let us help you, as we have helped so many other wholesalers, create your PVP.

Check out all our coaching options here or, if you prefer to go it alone, grab the online course that’ll show you how it’s done.

Also check out my conversation with Broadridge’s Tim Kresl: Data and a Wholesaler’s Search for Deeper Advisor Relationships

Meanwhile, read on…

You may have seen the article at WealthManagment.com titled The Next Gen Wholesaler.

According to their Managing Editor: WealthManagement.com sent out an emailed survey to a sample of the publication’s database, asking advisors for their views on mutual fund wholesaling and distribution. More than 1,000 advisors responded from across the different channels, including wirehouses, regional firms, independent broker/dealers, insurance firms, bank brokerages, private banks/bank trusts and RIAs.

The findings both reinforce what we have been writing about (and in some cases previously reported via our own advisor survey way back in 2012) and brings current the fact that advisors expect and deserve to engage with highly informed, consultative and well-rounded wholesalers.

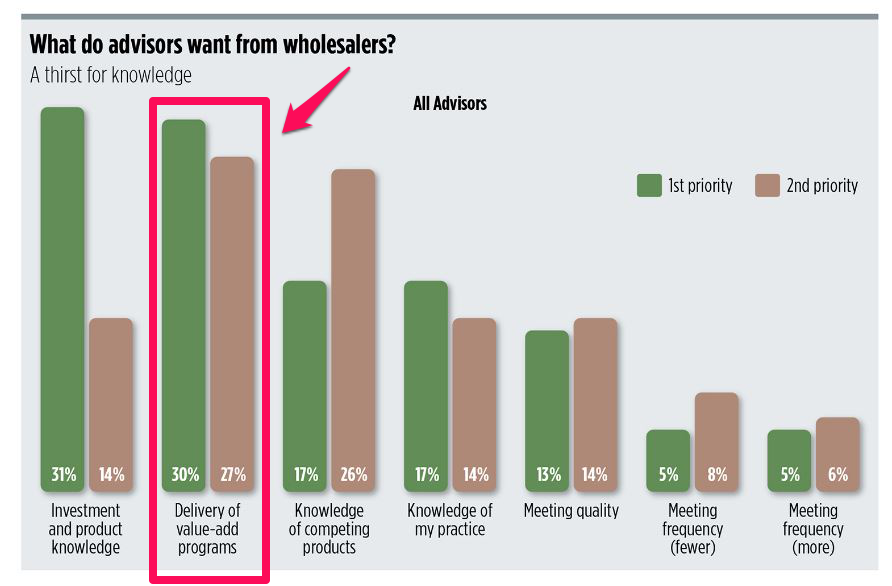

In our opinion, this one chart tells the most powerful story – a story that, if you are not listening, will prove to be the treacherous slope on which you wholesale.

source: WealthManagement.com “The Next Gen Wholesaler” May 2017

That story is further articulated by a Millionaire Wholesaler that we interviewed a few years ago who said:

“You must be more to clients

and prospects than just your product.”

These Value-Add Programs can be found in the form of:

- Research work done by your firm: think Generational Wealth Transfer, Woman and Investing, Behavioral Finance, Social Selling, Health Care and Financial Planning, Social Security, etc.

In too many cases firms have invested a ton of money in programs like these; programs that too few wholesalers have engaged with.

We know, as in a past life we commissioned and paid for these value add programs, only to see them wither on the literature room shelf.

If you have the good fortune of programs like these being available at your firm, get busy perfecting your knowledge.

- Take it upon yourself to create your own value-add (we call it your PVP-Peerless Value Proposition®).

It’s what we have been imploring you to do for the better part of a decade

in this post,

and this post,

and this post,

and this post,

and this post,

and this video,

and this course,

and in our live presentations.

We all know that the steak and whiskey wholesaler died a cirrhosis induced death many years ago.

And in order to secure your place as a trusted partner – and a survivor in the future world of wholesaling – you need to up your non-product game…sooner versus later.

A Wholesaler’s Honeypot Paradox

A Wholesaler’s Honeypot Paradox Make a Fortune, Have a Life, or Both?

Make a Fortune, Have a Life, or Both? 83 Ways to Make 2019 Your Career Year

83 Ways to Make 2019 Your Career Year Three Muscles Great Wholesalers Are Strengthening

Three Muscles Great Wholesalers Are Strengthening One Absolutely Foolproof Way Great Wholesalers Stay Out of The Sea of Sameness

One Absolutely Foolproof Way Great Wholesalers Stay Out of The Sea of Sameness