Between July 21 and August 2 Wholesaler Masterminds® conducted a survey of our US and Canada based community. We requested survey responses through direct email outreach, LinkedIn, Twitter and Facebook.

We received 847 total responses. In addition we received over 800 written comments.

This is Part 4 of our effort to provide you with an overview of the Survey results.

Click here to view the Survey Participant Census Data.

Distributor margins continue to compress due to:

- Fee pressure

- Passive/active and proliferation of ETFs

- Managed platforms

- Cybersecurity

- Aging advisors

- Risk management controls

- DOL/Compliance costs

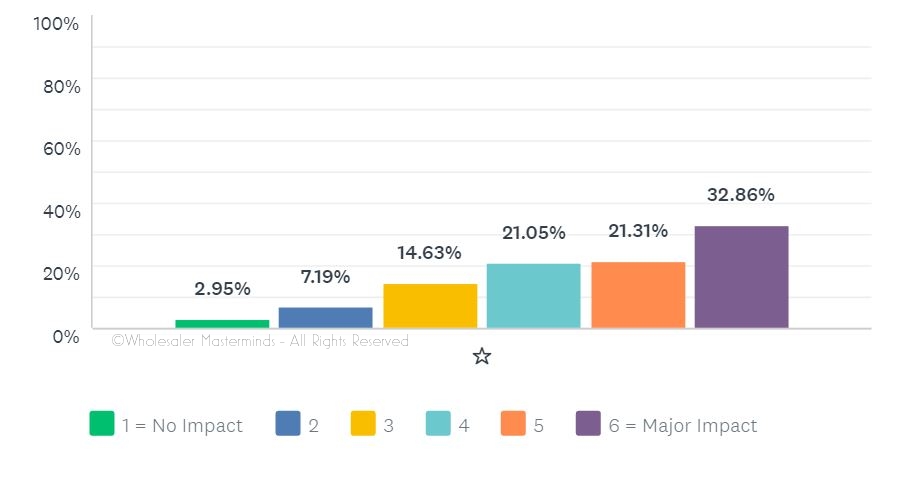

To what extent do wholesalers believe their income will be affected by current trends in the industry?

We asked:

Whether you work in investment management or insurance, your firm’s earnings (due to issues such as DOL, fee pressure, aging advisors, passive/active, managed platforms, etc.) are likely compressing.

How much impact do you think these issues will have on your personal income potential over the NEXT THREE YEARS?

Many See The Inevitable

“Firm profits have always, and will continue, to supercede average compensation. Profit compression will surely come at the expense of wholesaler comp.”

“Given active/passive flows, coupled with fee compression, I do not think active managers will be able to see enough to offset the lower fees, which will absolutely impact my personal income.”

“I expect pay and how it’s is calculated (deferred, subjective, net sales) to change significantly.”

“Margins are shrinking and the most vulnerable will be wholesalers.”

Some Already Feeling The Impact

“Our commissions have already been reduced multiple times over the next 12 months.”

“I don’t think there is an effort to reduce wholesaler compensation at my firm, BUT I do believe they always want more done to make the same money. If you sell what they want (hit your initiatives) you will do OK. Otherwise, not so much. Stock options have added a lot less to my income in the past ten years, versus my first ten years.”

“Already has – 3 years in a row of declining income without declining production.”

“I, and many others I know, have experienced 30-50% reductions in commissions. The ones that have lost their jobs are struggling to find employment.”

“I’m a new wholesaler, but it’s not hard to see it’s not the same compensation environment of the past.”

Behavioral Change Will Be Required

“More money will be spent on smart data. This will potentially allow for territory cuts. Wholesalers will have to prove to management they are becoming partners versus vendors to advisor’s practices.”

“I think our roles have never been more complex and have never required so much ‘juggling’ of many different things. Those who are best and continue to forge forward, will be paid accordingly; not concerned.”

“The old timers will not like the new return on effort metric and allow for younger, more efficient, hungry and committed replacements to succeed.”

“I think the comp plans will evolve to reward those that are finding new business and less around farming the same accounts and shuffling assets between funds.”

Though The Impact Varies By Product

“I will make more money in the future. I believe FAs will look to insurance solutions for more comp.”

“I don’t feel Private Placement will be impacted as much as Mutual Funds.”

“Hope to drive more focus on profitable products like life insurance.”

“Work with a firm focused on fixed income. Advisors continue to offer active and the delta on active/passive fixed income is smaller versus equities.”

Not All See Downside

“We’ve seen the compression already. Sales and distribution is still the name of the game. So it’s all about getting better, more efficient, and smarter about territory management. The very best will always find a way to make money.”

“Good Wholesalers will continue to earn decent money.”

“I feel like top guys at top firms will widen the income gap; firms are looking at cost per wholesaler and top guys bring the most value. Average wholesalers will no longer make great money, in fact, average wholesalers in many cases must accept below (historical) average comp.”

“Good sales are still good sales. Money will be made by the hungry regardless.”

“Compensation has been coming down for years. Product pricing pressure will continue as alternatives gain in popularity. Margins will shrink and that will force compensation to continue to adjust. The bright side is the new technologies will help efficiency and quality of life. A fair trade in my assessment.”

“Margins are tighter and wholesalers will be impacted. However, with less product differentiation distribution will be the only differentiator. Consequently, top wholesalers will still be compensated well. ”

Stay tuned to Wholesaler Masterminds® for additional results from our 2017 State of Wholesaling Survey.

Good News! I Got Fired and I’m Leaving Wholesaling

Good News! I Got Fired and I’m Leaving Wholesaling 5 Ways For Wholesalers To Cope With Feeling Overwhelmed

5 Ways For Wholesalers To Cope With Feeling Overwhelmed Two Proven Ways to Become a Better Listener

Two Proven Ways to Become a Better Listener 51 Posts Every External Wholesaler Needs To Read

51 Posts Every External Wholesaler Needs To Read Wholesaler Dilemmas – Your Questions Answered

Wholesaler Dilemmas – Your Questions Answered