Between July 21 and August 2 Wholesaler Masterminds® conducted a survey of our US and Canada based community. We requested survey responses through direct email outreach, LinkedIn, Twitter and Facebook.

We received 847 total responses. In addition we received over 800 written comments.

This is Part 2 of our effort to provide you with an overview of the Survey results. See Part 1 here.

Click here to view the Survey Participant Census Data.

The advisor population in both the US and Canada is aging.

[Read: EY Study -The Next Generation of Financial Advisors]

We asked:

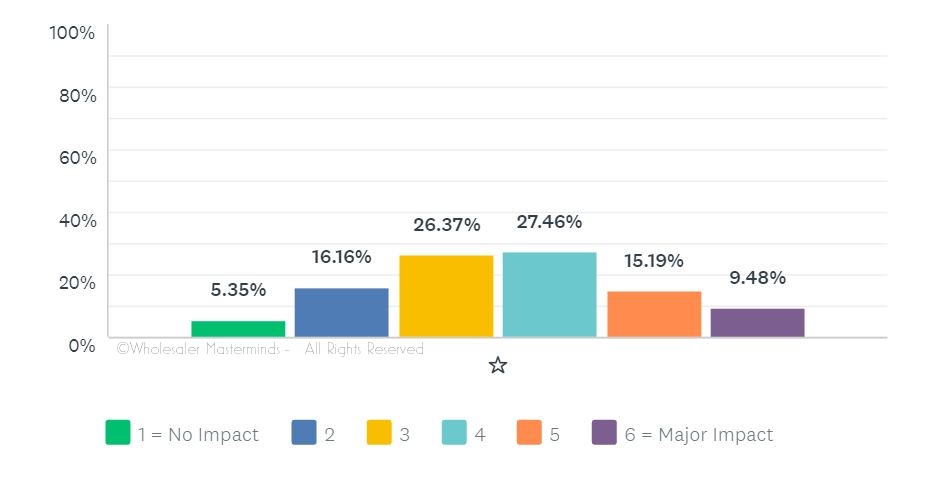

As the average advisor is approaching 60 years of age in the US and Canada, how much will your business be impacted by this aging population of Financial Advisors over the NEXT THREE YEARS?

Wholesalers have a range of reactions to this trend:

Implications for Advisors

“There will be fewer advisors and a greater concentration of wealth will be with the top ones. The newer advisors coming in to the business will be on salary and make less.”

“Advisors already looking to bring on millennials to take over book.”

“There will be fewer solo practices and more teams made of specialists including Insurance, Asset Managers, CPA’s, and attorneys to create trusts.”

“Most advisors over age 60 plan to work until their health deteriorates and requires them to step down. They love what they do and they love their clients.”

“Very few have done a good job with session planning and some are lifestyle advisors i.e. their book will die with them.”

“Clients are going to need to be serviced by someone. Smaller accounts will go to call centers, so I am guessing the population of advisors is going to shrink.”

“We are seeing more partnerships with younger advisors starting. The results have not been always good.”

“Technology seems to have taken the place of mentoring and young professionals do not get the training they desperately need.”

Implications for Wholesalers and Firms

“I attempt to apply equal amount of effort to both sides. I cannot ignore those who brought me to the dance, but it would be foolhardy to ignore the ones who will eventually cut in.”

“We will have to train the next generation of advisors to sell our products. Most tenured wholesalers don’t want to do that.”

“Need to be building relationships with junior partners, will not impact business if we are building the right relationships.”

“At this point no impact, until the next recession. There will be lots of books for sale and those younger advisors looking to buy will have a lot to choose from. It also means there will be fewer advisors to call on, but the ones we do call on will have more AUM.”

“More impact on the insurance selling landscape. Not enough next-gen advisors doing insurance business.”

“Although this will impact business to some extent, I have seen a new generation of younger advisors that understand the purpose of protection products for clients.”

“Because I am also over 50 years of age and have been a wholesaler for over 30, my peers are the ones leaving the biz, need to be more diligent about meeting the younger advisors that have been added to teams.”

“This is the number 1 concern of any knowledgeable carrier or wholesaler. My company is expanding into other distribution channels and is now working with multiple “network marketing” financial services organizations. These are the only organizations bringing new people to the industry.”

“There is a LOT of assets in transition. I attempt to split my business with tenured advisors and younger up-and-comers in hopes that when the transitions occur all of my relationships are not completely lost.”

“The major Wirehouses are reluctant in this environment to recruit veteran FA’s due to their ability to use the firm models. The new recruits coming out of b-school will be trained less on rep as PM and more on firm as PM. This will decrease wholesaler ability to influence product placement as the branch level.”

Finding Opportunity in Change

“I am having a conversation with every advisor about practice succession. This is a huge opportunity!”

“It’s a blessing for me; old producers have older clients and older clients have greater needs.”

“The impact at my client firms will be the transition of business from aging FA to young FA. This will be good for my business as the aging [FA] seldom do new things with me.”

“It has presented opportunity from an old way of thinking to a new. And the young trainee that most other wholesalers ignored is now calling the shots and he remembers that we were there when no one else was.”

“The retiring of senior advisors has actually been good for my business. The new FA comes in and is fresh with new ideas and typically uncovers additional assets.”

“We are starting to see a lot of junior advisors pair up with those tenured corner office reps. This dynamic jives well, allowing us to start growing relationship with younger advisors thus easing the transition.”

“Younger IA’s who are moving up the ranks and growing their books are even more open to ETF usage, this is a positive.”

“This could have a positive impact on my business. Younger advisors are far more open to the idea of looking outside North America to access the strong, risk-adjusted returns available in emerging markets.”

Stay tuned to Wholesaler Masterminds® for additional results from our 2017 State of Wholesaling Survey.

Fat and Happy Wholesaling

Fat and Happy Wholesaling A Sign From Above

A Sign From Above Cut Through The Communication Clutter: Use LinkedIn To Leave A Voice Message

Cut Through The Communication Clutter: Use LinkedIn To Leave A Voice Message Gumby, Pokey and the Wholesaling Sea of Sameness

Gumby, Pokey and the Wholesaling Sea of Sameness 40 Adjectives That Describe Great Wholesalers

40 Adjectives That Describe Great Wholesalers