Between July 21 and August 2 Wholesaler Masterminds® conducted a survey of our US and Canada based community. We requested survey responses through direct email outreach, LinkedIn, Twitter and Facebook.

We received 847 total responses. In addition we received over 800 written comments.

This is Part 1 of our effort to provide you with an overview of the Survey results.

Click here to view the Survey Participant Census Data.

Many wholesaler survey respondents are feeling the impact of increased regulatory oversight.

We asked:

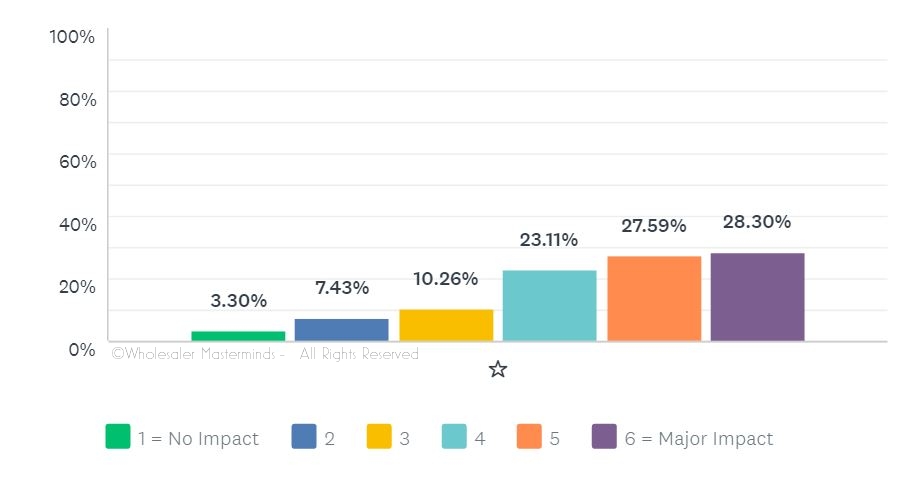

Whether it’s DOL or CRM2 (Canada), how has your business been affected by broker/dealer and advisor reactions to increased regulatory oversight?

These impacts are evidenced in a host of ways:

Availability of Advisors

“Tougher to get meetings scheduled”

“Distraction, advisors’ excuse to avoiding meeting”

“Main concern is reduced advisor focus/attention due to DOL priorities”

Advisors Stymied into Inactivity

“No advisor or firm wants to be the first example to be made, despite the need for advice and service. It has been an easy excuse for advisors to do nothing”

“They’re deer in the headlights…”

“With so much gray area, many are paralyzed”

“A lot of advisors have been paralyzed with inaction because they weren’t sure what the rule or their BD was going to do”

Product Appoval/Selection/Behavior

“It’s another distraction FAs use to not listen to a new partner opportunity”

“Advisors seem reluctant to make investment decisions and firms seem to be steering advisors towards using their models. I feel like I have less impact on investment decisions than ever before”

“A lot of our company’s products have been taken off the shelf due to perceptions about the rules. The rule has created an environment in which we must be a lot more narrow and nimble in the firms we focus on”

“DOL has sapped BD DD time and attention to reviewing new product offerings”

“Advisors scared to offer traditional brokerage products that may actually be in client best interest bc either not worth risk of potential class action or just too hard to get business done with all of the additional documentation etc.”

Complying with Changing Broker Dealer Guidelines

“The confusion caused by the rule is pervasive in the independent space causing a wide variety of reactions from disallowing alternatives in qualified accounts to no changes at all”

“The DOL has absolutely affected our business in a negative way firms are rationalizing their list of funds pushing advisors to firm models both ETF and funds”

“The major issue is the distraction and the lack of ability for advisors to prospect and gather assets for an extended period of time due to the uncertainty and inconsistent application of the regulations”

“Firms are using DOL as an excuse to push advisors to home office model portfolios. That greatly reduces my ability to influence investment decisions, and consequently flows”

“Tracking new “rules of engagement” from each broker/dealer is a bear when you work with 200 different broker/dealers!”

General Frustration

“I’m in the retirement plan industry, and the new DOL rules have practically ground down our industry to a near halt while awaiting the results. The election of Trump only slowed things down further, as brokers awaited further guidance on what the new administration would do with the DOL rules. We are STILL awaiting final guidance!”

“I think the majors colluded with the Government to control the FAs”

“The sad reality is the company that I represent has done very little to prepare”

Though not all wholesalers see the impacts being negative:

Advantaged by Product/Channel

“I work as an ETF wholesaler in Canada and our sales are through the roof at the expense of my mutual fund wholesaling colleagues. CRM2 has definitely impacted this, so has POS3 (rule that came in last year after which non-discretionary advisors have to provide additional regulatory documentation to their clients prior to executing a mutual fund purchase order)”

“Is an actually a benefit for us (mutual fund model portfolio strategist) ”

“Increasing willingness to look at TAMPS and stops rep as manager”

“As a no load shop most changes have been at the operational platform level. That has included some product rationalization but the impact has been limited”

“Fees fees and more fees. We have seen advisors more interested in ETFs. As well, with advisor fees being shown now, there is performance sensitivity”

Money in Motion

“It has made money move and meant more opportunity”

“It has increased my activity with advisors”

“Net positive. Move to fee based AUM ”

“I have more advisors asking for advice on managed accounts as well as looking for other options to select funds”

“We’ve been positioned really well for money-in-motion opportunities and have benefited from growth in sales as FAs look to work with firms that are truest adding value”

Better Advisors/Wholesalers Come Out on Top

“Top advisors don’t feel threatened or concerned about this topic, they do what they do well and know they add value every day”

“The best advisors see a fiduciary standard as something that they should have been doing all along. It doesn’t mean they like the regulation, but they understand the need for it”

“While there has been a major impact, there has never been a better time to focus on what differentiates you”

“Most of the advisors I’ve worked with historically have a strong advisory focused business”

Stay tuned to Wholesaler Masterminds® for additional results from our 2017 State of Wholesaling Survey.

A Wholesaler’s Second Chance

A Wholesaler’s Second Chance Why Wholesalers Should Take The Stairs – Rory Vaden

Why Wholesalers Should Take The Stairs – Rory Vaden Breaking The Golden Rule

Breaking The Golden Rule Wholesaler Survey 2011 – The Results: Part One

Wholesaler Survey 2011 – The Results: Part One How Wholesalers Can Attract a Boatload of Ideal Clients – Annette Bau

How Wholesalers Can Attract a Boatload of Ideal Clients – Annette Bau