In 2009 Wholesaler Masterminds began to survey the wholesaling community. Given the significant unrest in the industry in late 2009 we kept our questions brief and our focus tight. The results of that survey were centered around job satisfaction.

While the 2011 edition offers insights into the same questions, we expanded both the number of questions and the topics we surveyed.

This is Part 2 of our 2011 Wholesaler Survey Results. Part 1 of the findings can be found here.

Wholesaler Job Satisfaction

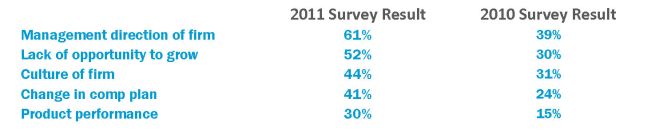

In our 2010 Wholesaler Satisfaction Survey we asked if wholesalers were considering a change to a new firm and received a healthy 69% majority of yes responses.

For 2011 the trend appears to have have reversed itself. It fact this year’s survey has the majority of respondents not contemplating a move.

Are you contemplating a job change to a new firm in 2011?

While the reasons for this shift are as varied as the respondents, we suspect that there are 3 key reasons for this reversal:

- The V shaped market recovery has virtually all wholesalers feeling considerably more optimistic than late 2009 when our first study was done.

- Most firms have taken the painful right-sizing steps necessary. As a result wholesalers are less tentative about the stability of their jobs.

- Wholesalers still appreciate the difficult nature of the job market and are hesitant to move in the face of that uncertainty.

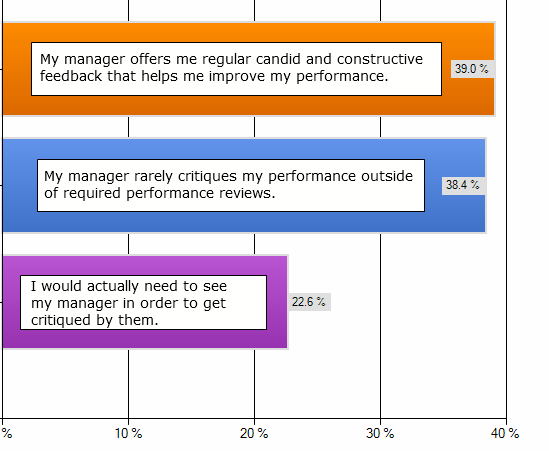

For the 48% that are thinking about making a change, their overall reasons are consistent with the findings of the 2010 survey. For 2011 the two most prominent motivators to leave are wholesaler’s fundamental disagreement with the overall direction of the firm and the perceived lack of opportunity to grow.

We believe that the firms can do a better job of providing growth opportunities to wholesalers – and that does not necessarily mean promotional opportunities are the only answer. After all, not every wholesaler deserving of a promotion will get one (there are only so many management slots), nor is every wholesaler ready to take the next career step up the firm’s leadership ladder – even if they believe they are.

“Opportunity to grow” for top performing wholesalers may mean:

- the ability to participate in mentor programs wherein they are called upon to be the mentor to less experienced member of the team.

- the ability to be mentored by a senior respected leader of the management team.

- they are called in to facilitate meetings with senior leaders at client firms.

- an expanded ‘platform’ – attendance at regional and/or national conferences with responsibilities that go beyond booth time.

- offering unique and targeted training and development opportunities tailored for top performing wholesalers.

Regardless of the ‘what’, we believe that wholesalers can achieve growth without necessarily leaving the firm or getting immediately promoted.

The additional comment quotes we received regarding reasons to explore other opportunites were:

- Overall compensation

- Territory reduction and loss of relationships

- The internal base salary is significantly less than the industry average and even by exceeding the $6 million sales goal the comp structure at $1,000 per million won’t add enough significant upside to the overall salary.

- This place is a mess, starting with senior management.

- Lack of name brand recognition a hindrance; as an arm of a bank we are particularly bureaucratic; product performance has been good, but product breadth is narrow.

- Company wants to manage risk (Good) and reduce sales by Externals (Bad).

- Poor decision making by direct manager.

- Looking to get back to Mutual Funds, SMA, IPO, ETFs.

- Unwanted change in territory composition.

- My company has hung its hat on a new product that offers a powerful but small value proposition. And expects to grow from 80MM to 800MM this year.

Management Communication to Wholesalers

In our one on one and group coaching we have found that a number of wholesalers are dissatisfied with the frequency and styles of communication that they get from both their immediate manager and from the broader management team.

As a result, this year we asked two questions around that issue:

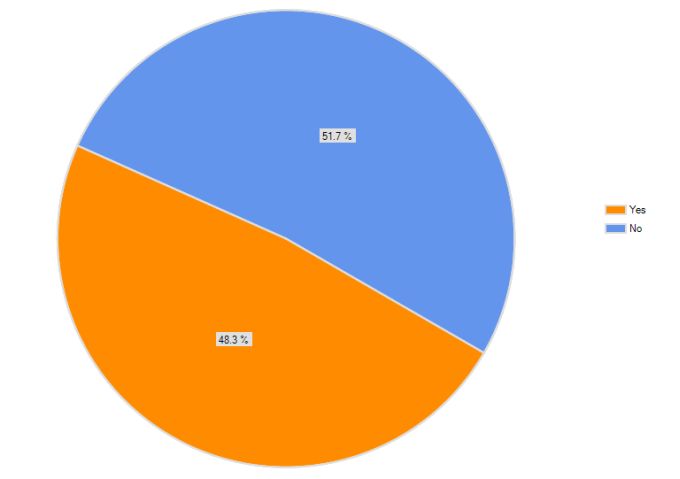

Think about the communication you have with your management team and select one of the following statements:

- Management keeps us informed and I generally feel like my voice is heard. 33.3%

- Management passes along their edict without much input and wholesalers are expected to comply. 31.9%

- It depends. Sometimes management needs to manage. Sometimes they ask for our input. 34.7%

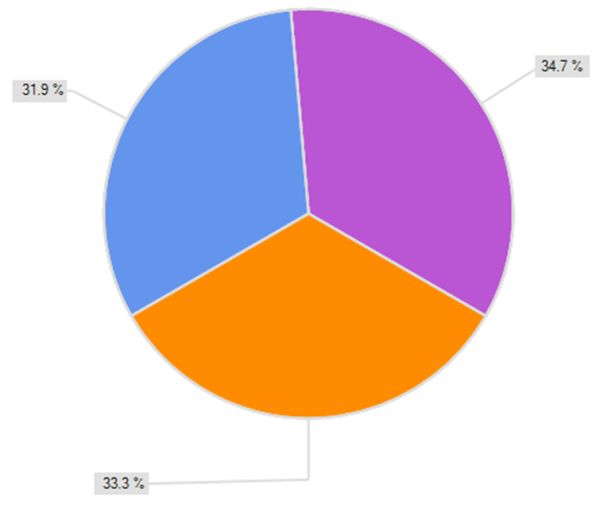

Think about the relationship you have with your manager and select the statement that most closely applies:

According to the survey results less than 40% of wholesalers are receiving regular, candid, and constructive feedback. And almost 40% of respondents say that their managers only offer feedback in the context of a formal (firm mandated?) performance review.

Perhaps most disappointing is the survey statistic that indicated that almost 1/4 of wholesalers do not see their immediate manager.

Wholesalers are ready willing and able to receive, process and act upon the right feedback, presented in the appropriate manner. Why then are managers failing to deliver the necessary critiques?

We suppose (and, as always, welcome your insights via the comments below) that managers:

- often have a span of control that makes their ability to touch each wholesaler with the right frequency and appropriate insights difficult at best.

- feel that their most talent wholesalers will not be receptive to or do not need their input (big mistake).

- are ill equipped. So many managers are former wholesalers whose next ‘logical’ step was management. In making that leap no one prepared them for how to have these types of discussions with their former peers, now direct reports.

The additional comments we received were:

- Regular feedback? Yes. Constructive? No.

- Sometimes too candid.

- A compliment every now and then would be nice.

- My manager never wholesaled and is has no understanding of my job/life.

- I don’t get along with my manager

We speak to sales managers (divisional, national, etc.) every week that wonder about where their training and development dollar should be next spent. In this year’s survey we asked:

What skill(s) do you need to improve upon in 2011 to take your wholesaling to the next level?

- Getting appointments 46.2%

- Closing/gaining commitments 45.5%

- Competitors product knowledge 37.2%

- Manage time more effectively 36.6%

- More organized 29.7%

- Group presentations 24.8%

- One on one profiling 22.8%

- Technology (includes social media) 21.4%

- Better student of the business 20.0%

- Product knowledge 11.0%

2011 Survey Demographic Information

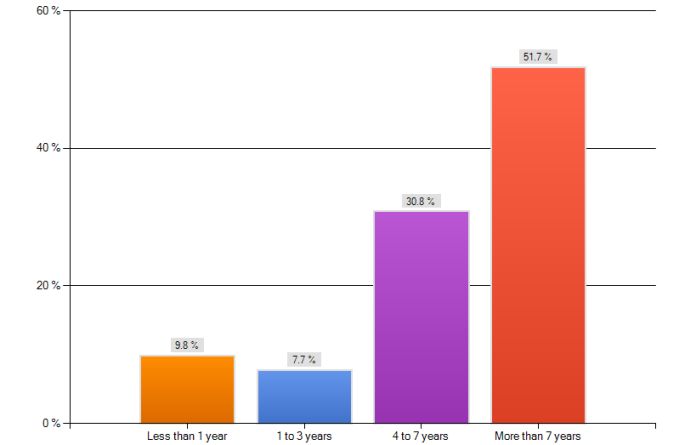

How long have you been an external wholesaler?

What product(s) do you wholesale? (check all that apply):

- Mutual Funds 54.9%

- Fixed Annuities 20.4%

- Variable Annuities 19.7%

- Alternatives 21.1%

- Life Insurance 16.2%

- Long Term Care 7.0%

- Other (please specify) 31.7% (this group included SMA, 529, 401k, ETF, etc.)

What was your 2010 income?

At Wholesaler Masterminds we welcome the opportunity to:

- further discuss any of the survey results presented.

- strategize ways in which our coaching and training expertise can assist both individual wholesalers and their managers in address the issues presented by the survey findings.

Contact us and we’ll reply promptly. Lastly, I Carry The Bag…the official magazine of wholesaling has eclipsed a readership of over 1000 in less than 12 months. Why not start a subscription for yourself or your team today?

The 2011 Wholesaler Masterminds Survey was conducted January 9th through February 16th 2011. A total of 158 participants took the survey which was administered through direct email outreach and through various LinkedIn wholesaler groups.

We Need To Make A Change

We Need To Make A Change 10 Daily Keys To Wholesaler Success

10 Daily Keys To Wholesaler Success The Future of Wholesaling Looks Bleak

The Future of Wholesaling Looks Bleak 8 Ways Great Wholesalers Prepare For Vacation

8 Ways Great Wholesalers Prepare For Vacation Keys To Advisor Scheduling Success

Keys To Advisor Scheduling Success

Rob says

[A reader provided an email comment (thanks)]

The difference in wholesaler products or services in their answers is huge and not reflected.

Investment products – market has moved from 6500 to 12000 in 2 years. Clients are returning. RIA business is growing.

Insurance products. Big need, but companies are reeling from low re-investment returns, surplus demands and surrenders by clients who were cash strapped.

Insurance companies have turned to IMO’s to be their field “wholesaling” force for life, annuiities and LTC. IMO’s pay no base, salary or draw, no benefits , no expenses and in many cases no producing territory with an existing sales volume.

How many wholesalers do you know that can try to build a territory in 6 to 12 months with no income?

From 1980 to 2008 every wholesale position I had provided a base plus commission, expenses and benefits. Then the past 3 years nothing. Nothing.

Best income year – $483,000 Worst – $42,000.

You need to look at the different industries.