Wholesalers hate change, after all we’re only human.

But change, and a bunch of it, continues to head our way.

How will you adapt to the change that’s coming?

Steven Miyao founded kasina and served as CEO since its inception. He is now President of DST kasina. He is one of the industry’s premier thought leaders and a financial services expert. He is a trusted advisor to the world’s leading financial services companies and has earned this status by providing forward-looking and pragmatic advice in regards to corporate strategy, product development and distribution issues.

Under Steven’s leadership, kasina has helped asset management and insurance leaders to answer two questions:

What will the future look like?

What do we need to do to stay ahead?

Since kasina’s inception in 1999, its commitment to answer these questions has made it one of the most influential strategy consulting firms in the financial services sector.

kasina’s consulting, research and benchmarking services have impacted over 100 companies around the globe that comprise over $8 trillion in assets under management.

The Impact of Change on Distribution

The catalysts of change in our industry have accelerated, fundamentally changing the competitive environment. Technology, transparency, fee compression, consumer expectations, product commoditization, the balancing of active and passive investments, goals-based wealth management, the evolving business models of financial advisors and new financial regulations are putting ever more pressure on asset manager distribution organizations to perform at higher levels.

With organic growth squeezed, many advisors, broker/dealers and asset managers are seeking efficiencies to alleviate margin pressure, while simultaneously trying to grow their assets through more targeted business development efforts and strategic M&A opportunities.

Consolidation is reshaping the landscape for advisors and asset managers alike. According to DST’s analysis of Morningstar data, as much as $3.3T in actively managed mutual funds could be in motion through product rationalization, posing both a risk (outflows) and an opportunity (inflows) for asset managers. The number of broker/dealers is shrinking steadily, RIAs are consolidating at a record rate, recommended lists are getting smaller and harder to penetrate, and according to Investment News, 43% of distribution firms are seeking to merge or make an acquisition within the next two years, significantly stepping up the pace of consolidation.

These powerful industry trends have created an imbalance for asset managers trying to navigate the changing landscape. Some firms are currently unprepared to tackle the challenges that will redefine the industry over the next few years. But for asset managers that focus on creating operational efficiency and building scale and/or providing differentiated and uniquely specialized products and services, the future offers tremendous growth opportunities.

The future of sales, marketing and product development in asset management is centered on high-value, personalized engagement and delivery of solutions. Leading asset managers will need to achieve operational scale and product breadth and/or specialize in order to provide unique value propositions to their clients. At the same time, they must find balance among competing priorities by transitioning their organizations toward business models that are efficient, tailored to current and future advisor needs, and capable of engaging advisors as trusted consultants, ready to solve problems within their practices.

Current sales models are not sustainable

Long-term industry trends will ultimately result in fewer advisors who are less frequently able or willing to buy products from asset manager sales teams. Sales models must focus on the most important relationships and activities that can produce the desired sales outcomes. Coverage of advisors has to align the skills of the salesperson with the level of an advisor’s sophistication.

Sales teams have fewer opportunities to influence purchasing decisions In 2016, 64% of all AUM was managed with investment selection outside the direct control of advisors (research analysts, models, etc.) — up from 55% in 2013.

RECOMMENDATIONS

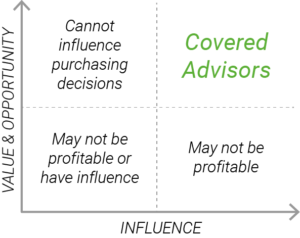

As fewer advisors have discretion, sales teams must change how they target, cover and engage with advisors.

Do not cover all advisors

Work with the Business Intelligence team to identify advisor practices that are using models, programs or platforms in which the investment decisions are outsourced. Do not cover these advisors because the sales team cannot influence purchasing decisions.

Focus coverage on value and profitability

For advisors that can be influenced, use segmentation to identify advisor practices in which product and service needs align with the strategic direction of the asset manager and represent strong revenue and profitability potential.

Prepare sales teams to sell to only these advisors

Assign coverage based on the sophistication of the advisor and skills of the salesperson. Upskill the salesforce to match the sophistication level of advisors and approach advisors based on the advisor’s preferences.

Not all advisors deserve coverage by the sales team

To remain relevant in a changing distribution landscape, sales organizations must focus on the right advisor relationships, upskill the salesforce and leverage the full resources of the asset manager.

Taking advantage of data analytics with assistance from the Business Intelligence team and a strong segmentation model, sales teams can help asset managers remain profitable by focusing on identifying and building the right relationships — those with strong sales growth opportunity that align with the asset manager’s strategic direction in which the sales team can actually influence the purchasing decision.

Salespeople need to move beyond just identifying the right advisor targets; they must also identify and understand the nuances of key stakeholders on the advisor team who have influence over purchasing decisions and the sophistication of those stakeholders to appropriately assign coverage.

Written by Steven Miyao, Head of DST Research Analytics and Consulting

Fess Up Wholesalers, Better LinkedIn Useage Belongs In Your Practice’s Toolbox with Laura Virili

Fess Up Wholesalers, Better LinkedIn Useage Belongs In Your Practice’s Toolbox with Laura Virili Wholesaler Masterminds Radio Pod Pack #1: Industry Education and Trends

Wholesaler Masterminds Radio Pod Pack #1: Industry Education and Trends Becoming an Irreplaceable Wholesaler with Penny Phillips

Becoming an Irreplaceable Wholesaler with Penny Phillips Any Wholesaler Can Do Anything with Kyle Maynard

Any Wholesaler Can Do Anything with Kyle Maynard How to Successfully Partner with Corner Office Advisors with Richard Weylman

How to Successfully Partner with Corner Office Advisors with Richard Weylman